Description

What is Transfermovil APK ?

Transfermovil is a mobile application designed to facilitate electronic financial transactions in Cuba. With a user-friendly interface, the app allows customers to carry out various banking operations, such as transferring money, paying bills, and managing accounts, directly from their smartphones. Users can link their bank cards to the app, enabling secure and convenient transactions. Transfermovil plays a significant role in modernizing Cuba’s financial landscape, providing citizens with a digital platform to access essential banking services and conduct transactions without the need for physical branches. It serves as a pivotal tool in the country’s efforts to embrace digital financial solutions and enhance financial inclusion.

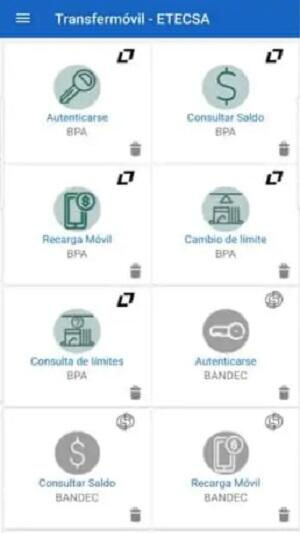

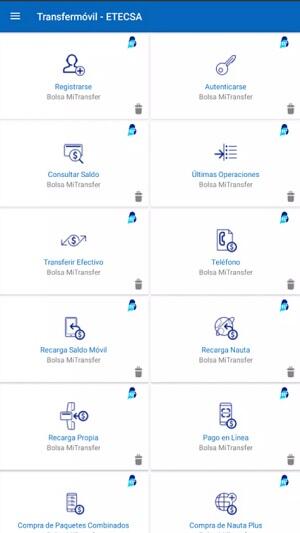

Interface of Transfermovil APK latest version

The interface of Transfermovil is designed with user-friendliness and simplicity in mind. Upon opening the app, users are greeted with a clean and intuitive layout, making navigation straightforward even for those unfamiliar with digital banking. The main screen typically displays essential options, such as money transfer, bill payment, and account management.

When initiating a transaction, users are guided through step-by-step processes, ensuring a smooth experience. The interface provides clear instructions and prompts, allowing users to input recipient details, transaction amounts, and confirmations with ease. Security features, such as PINs or biometric authentication, add an extra layer of protection to ensure the safety of users’ financial activities.

Features in Transfermovil APK new version

Transfermovil offers a range of features to enhance the digital banking experience in Cuba:

Money Transfer: Users can easily transfer money between their own accounts or to other bank accounts within the country. This feature allows for quick and convenient peer-to-peer transactions.

Bill Payment: The app enables users to pay utility bills, such as electricity, water, and phone bills, without the need to visit physical payment centers, saving time and effort.

Mobile Top-up: Users can recharge their prepaid mobile phone credits directly through the app, making it convenient to stay connected.

Account Management: Transfermovil allows users to check their account balances, review transaction histories, and manage personal information, providing better control over their finances.

Card Linking: Users can link their bank cards to the app, enabling seamless and secure transactions without the need to carry physical cards.

QR Code Payments: The app supports QR code-based payments, allowing users to make purchases at participating merchants using their smartphones.

Foreign Currency Exchange: Transfermovil facilitates foreign currency exchange transactions, catering to travel and international payment needs.

Request Money: Users can request money from their contacts, streamlining the process of receiving payments.

Security Measures: The app incorporates robust security features like PINs, biometric authentication, and encryption to safeguard users’ financial information and transactions.

Customer Support: Transfermovil typically provides access to customer support within the app, allowing users to seek assistance for any issues or queries they may have.

How to free download Transfermovil APK new version for Android

- Visit the Official Website: Go to the official website of Transfermovil or the platform where the app is hosted.

- Locate the Download Section: Look for a section on the website that provides options for downloading the app. It is usually labeled as “Download,” “Get the App,” or something similar.

- Choose Your Platform: Transfermovil may be available for both Android and iOS devices. Select the version that corresponds to your smartphone’s operating system.

- Follow Security Warnings: Depending on your device’s settings, you may encounter security warnings before downloading from an external source. Ensure you are downloading from a reputable website.

- Download the App: Click on the appropriate download link/button to initiate the download process.

- Install the App: Once the download is complete, locate the downloaded file (usually found in the “Downloads” folder) and tap on it to begin the installation process. Follow the on-screen instructions to install Transfermovil on your device.

Join the group to update information from the community:

Advantages and Disadvantages

Advantages of Transfermovil:

- Convenience: Transfermovil offers users the convenience of conducting various financial transactions right from their smartphones, eliminating the need to visit physical bank branches or payment centers.

- Accessibility: The app enhances financial inclusion by providing a digital platform for people to access banking services, even in areas where physical bank infrastructure is limited.

- Time-saving: Users can perform money transfers, bill payments, and other transactions quickly, saving time and effort compared to traditional methods.

Disadvantages of Transfermovil:

- Limited Availability: As of my last update in September 2021, Transfermovil was primarily available in Cuba. This limited availability might restrict its usage for those outside the country.

- Internet Connectivity: The app relies on internet connectivity to function effectively. In areas with poor or no internet access, users may encounter difficulties in using the app.

- Device Compatibility: Not all mobile devices might be compatible with Transfermovil, potentially excluding users with older or non-standard devices.

- Technical Issues: Like any digital platform, Transfermovil may experience occasional technical glitches, causing inconvenience or delays for users.

Conclusion

Transfermovil has the potential to transform the way people in Cuba access and manage their finances, offering them a more efficient and accessible banking experience. To fully realize these benefits, ongoing improvements, security enhancements, and continuous support from relevant financial institutions are essential. As the digital landscape evolves, Transfermovil’s continued development and expansion can play a crucial role in furthering financial inclusion and economic progress in Cuba.