Description

What is NetLoan APK?

NetLoan is a mobile application designed to facilitate quick and convenient lending and borrowing of money among users. The app provides a user-friendly platform for individuals to request loans, set their lending terms, and connect with potential borrowers or lenders within their network. NetLoan offers features such as credit scoring, transaction tracking, and secure payment processing, ensuring a reliable and safe environment for financial transactions. Users can customize loan terms, interest rates, and repayment schedules, making it a flexible tool for various financial needs. NetLoan aims to simplify the borrowing and lending process, promoting financial inclusivity and trust among its users.

Interface of NetLoan APK latest version

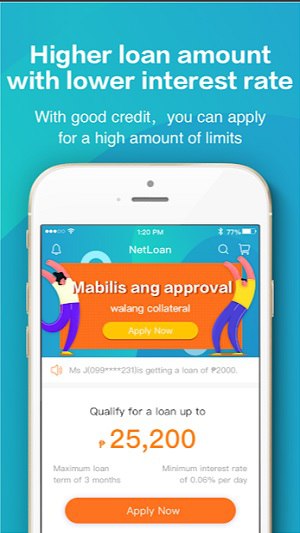

The NetLoan app boasts a user-friendly interface that prioritizes simplicity and functionality. Its design incorporates intuitive navigation, making it easy for users to access key features. The home screen typically displays a user’s account summary, including their available balance, pending loan requests, and recent transactions. The main menu allows users to explore various functions, such as requesting loans, setting lending preferences, managing their profile, and reviewing transaction history. NetLoan also provides a search and filter option for users to find suitable lending or borrowing opportunities within their network. The overall interface is designed for efficient and transparent financial interactions between users.

Some Features in NetLoan APK new version

NetLoan offers a range of features to enhance the lending and borrowing experience:

Loan Request: Users can easily request loans by specifying the desired amount, purpose, and repayment terms.

Lending Preferences: Lenders can set their lending criteria, including the amount they are willing to lend, interest rates, and repayment schedules.

Credit Scoring: The app often incorporates a credit scoring system to assess borrowers’ creditworthiness, helping lenders make informed decisions.

Transaction Tracking: Users can monitor the status of loan requests and track their transaction history for a transparent record of financial activities.

Secure Payments: NetLoan ensures secure and reliable payment processing, safeguarding users’ financial transactions.

Customizable Terms: Borrowers and lenders can negotiate and customize loan terms to meet their specific needs.

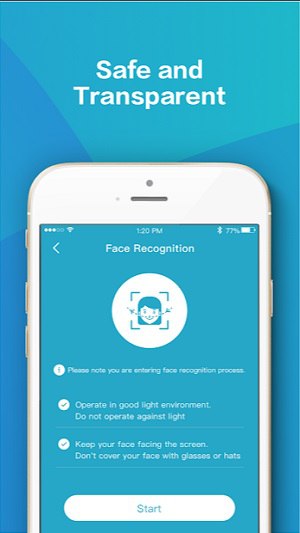

Profile Management: Users can manage their profiles, update personal information, and verify their identity for added security.

Notifications: The app typically sends notifications for loan approvals, repayments, and other relevant updates.

Social Connectivity: NetLoan may allow users to connect with friends or acquaintances in their network, making it easier to find trusted borrowers or lenders.

Help and Support: The app often provides customer support options for addressing any issues or inquiries users may have.

How to download NetLoan APK for Android

To download NetLoan from a website, follow these general steps:

Open Your Web Browser: Launch your preferred web browser on your computer or mobile device.

Search for NetLoan: In the search bar, type “NetLoan app download” or simply “NetLoan” and press “Enter.”

Visit the Official Website: Look for the official website of NetLoan in the search results. It typically ends with “.com” or “.net.” Click on the official website link to access it.

Navigate to the Download Section: Once on the NetLoan website, navigate to the “Download” or “Get the App” section. This is where you will find the download link or instructions.

Select Your Device: NetLoan may be available for various operating systems like iOS, Android, or Windows. Choose the version that matches your device (e.g., iOS for iPhones, Android for Android smartphones).

Download the App: Click on the download button or link for your specific device. This will initiate the download process.

Follow Installation Instructions: Depending on your device, the installation process may differ. For mobile devices, you may be directed to your device’s app store (e.g., Apple App Store or Google Play Store) to complete the download and installation. For desktops, you might need to run an installer file.

Accept Permissions: During installation, the app may request certain permissions. Review these permissions and accept them if you agree.

Launch the App: Once the installation is complete, you can launch the NetLoan app by clicking on its icon on your device.

Create an Account: If you don’t have an account, you’ll typically need to sign up by providing your information, such as name, email, and phone number.

Log In: If you already have an account, simply log in using your credentials.

Start Using NetLoan: You can now start using NetLoan to explore its features and services, including borrowing or lending money.

Advantages and Disadvantages of NetLoan:

Advantages:

- Convenience: NetLoan offers a convenient platform for users to access loans or lend money from the comfort of their mobile devices or computers.

- Accessibility: It promotes financial inclusion by providing access to loans for individuals who may have limited access to traditional banking services.

- Customization: Users can customize loan terms, interest rates, and repayment schedules, making it flexible and tailored to their financial needs.

Disadvantages:

- Risk of Default: Lenders face the risk of borrowers defaulting on their loans, potentially resulting in financial losses.

- Interest Rates: Some users may charge high-interest rates, which could lead to borrowers incurring significant debt.

- Privacy Concerns: Sharing financial information and transactions on the platform may raise privacy concerns, especially if not adequately protected.

Conclusion

NetLoan, like many peer-to-peer lending and borrowing apps, offers a convenient and accessible platform for individuals seeking financial assistance or looking to invest their money. Its advantages include convenience, customization, transparency, and the potential for financial inclusion. However, there are also notable disadvantages, such as the risk of default, high-interest rates, and privacy concerns. The reliability of credit scoring and limited regulatory oversight are additional considerations.

Users should approach NetLoan and similar apps with careful consideration of their financial needs and a clear understanding of the associated risks. It is essential to use such platforms responsibly, be mindful of the terms and conditions, and exercise caution to ensure a positive and secure financial experience.