Description

What is InstaMoney APK ?

InstaMoney is a mobile application that allows users to avail instant loans online. The app is available for download on Google Play Store and can be used by Android device users.

To get started with InstaMoney, users need to create an account and fill out a loan application form within the app. The application form requires users to provide personal and financial information, such as their name, address, employment details, and bank account information.

Once the application is submitted, the app’s proprietary algorithm analyzes the user’s creditworthiness and determines the loan amount that can be offered to them. The loan amount can range from Rs. 5,000 to Rs. 2,00,000, and the repayment period can range from 62 days to 180 days.

If the user agrees to the loan terms, the loan amount is disbursed to their bank account within minutes. InstaMoney charges interest on the loan amount, which varies depending on the loan amount and repayment period chosen by the user.

To repay the loan, users need to make timely payments through the app. The app sends reminders to users before the due date to ensure timely repayments and avoid penalties for late payments.

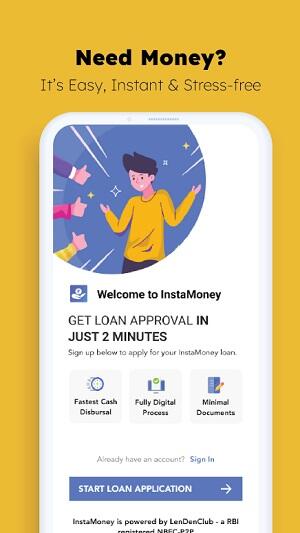

Interface of InstaMoney APK

The interface of InstaMoney is user-friendly and easy to navigate. Upon opening the app, users are greeted with a login screen where they can either log in to their existing account or create a new one.

Once logged in, users can access various features of the app, such as applying for a loan, viewing their loan details, and making repayments. The app’s home screen displays the user’s loan eligibility amount, which is calculated based on the user’s creditworthiness.

To apply for a loan, users need to fill out a loan application form within the app. The form is easy to fill out and requires users to provide personal and financial information, such as their name, address, employment details, and bank account information.

Users can also view their loan details, such as the loan amount, interest rate, and repayment period, on the app. The app provides a detailed breakdown of the loan terms and repayment schedule.

To make repayments, users can easily access the “Repay” section of the app and make payments using their bank account or other digital payment methods.

Features in InstaMoney APK

InstaMoney offers several features to users that make the loan application and repayment process convenient and hassle-free. Some of the notable features of InstaMoney are:

Instant loans: InstaMoney offers instant loans to eligible users, with the loan amount disbursed to their bank account within minutes of approval.

Loan eligibility check: The app’s proprietary algorithm analyzes the user’s creditworthiness and determines their loan eligibility amount, which is displayed on the app’s home screen.

Flexible loan amounts and repayment periods: Users can choose the loan amount and repayment period that best suits their financial situation. The loan amount can range from Rs. 5,000 to Rs. 2,00,000, and the repayment period can range from 62 days to 180 days.

Online loan application: Users can apply for a loan within the app by filling out a loan application form that requires personal and financial information.

Transparent loan terms: The app provides a detailed breakdown of the loan terms, including the loan amount, interest rate, and repayment schedule, so that users can make informed decisions.

Timely payment reminders: The app sends reminders to users before the due date to ensure timely repayments and avoid penalties for late payments.

Multiple repayment options: Users can make repayments using their bank account or other digital payment methods, such as UPI, debit card, or net banking.

Secure tran

How to download InstaMoney APK

sactions: InstaMoney uses encryption technology to ensure secure transactions and protect user data.

To download InstaMoney, follow these steps:

- Open the Google Play Store on your Android device.

- In the search bar, type “InstaMoney” and press the search button.

- Select the “InstaMoney – Instant Personal Loan Online” app from the search results.

- Click on the “Install” button.

- The app will start downloading and will be installed on your device within a few minutes.

- Once the app is installed, open it and create a new account or log in to your existing account.

- Complete the loan application process by filling out the necessary information.

- Upon approval, the loan amount will be disbursed to your bank account within minutes.

Note that InstaMoney is currently only available for Android devices and is not available on iOS devices.

Join the group to update information from the community:

Advantages and Disadvantages

Advantages of InstaMoney:

- Quick and easy loan application process.

- Instant loan disbursement to the user’s bank account.

- Flexible loan amounts and repayment periods to suit the user’s financial situation.

- Timely payment reminders to avoid late payment penalties.

- Multiple repayment options available.

- Transparent loan terms and interest rates.

- Secure and encrypted transactions to protect user data.

- No need for physical documentation or visits to a bank or lender.

Disadvantages of InstaMoney:

- The loan interest rates can be relatively high compared to traditional lending institutions.

- The loan eligibility criteria may not be suitable for all users.

- The loan repayment period may not be long enough for some users to repay the loan comfortably.

- The app is only available for Android devices and is not available on iOS devices.

- Users need to have a stable income and a good credit history to be eligible for a loan.

Conclusion

InstaMoney is a mobile application that offers instant loans to eligible users. The app’s user-friendly interface and quick loan application process make it a convenient option for users looking for a fast and hassle-free loan application process. Overall, InstaMoney offers a convenient and flexible way for eligible users to avail loans online, but users should consider the advantages and disadvantages of the app before applying for a loan.