Description

What is Golden Finger APK?

Golden Finger app is a versatile and innovative mobile application designed to provide users with a wide range of helpful features and tools. It offers a user-friendly interface and includes functionalities such as personal finance management, investment tracking, expense tracking, and budgeting tools. Additionally, the app provides real-time stock market updates, news alerts, and investment recommendations based on user preferences and risk tolerance. Users can also access educational resources related to finance and investing. With its intuitive design and comprehensive features, the Golden Finger app aims to empower users to make informed financial decisions and manage their money effectively.

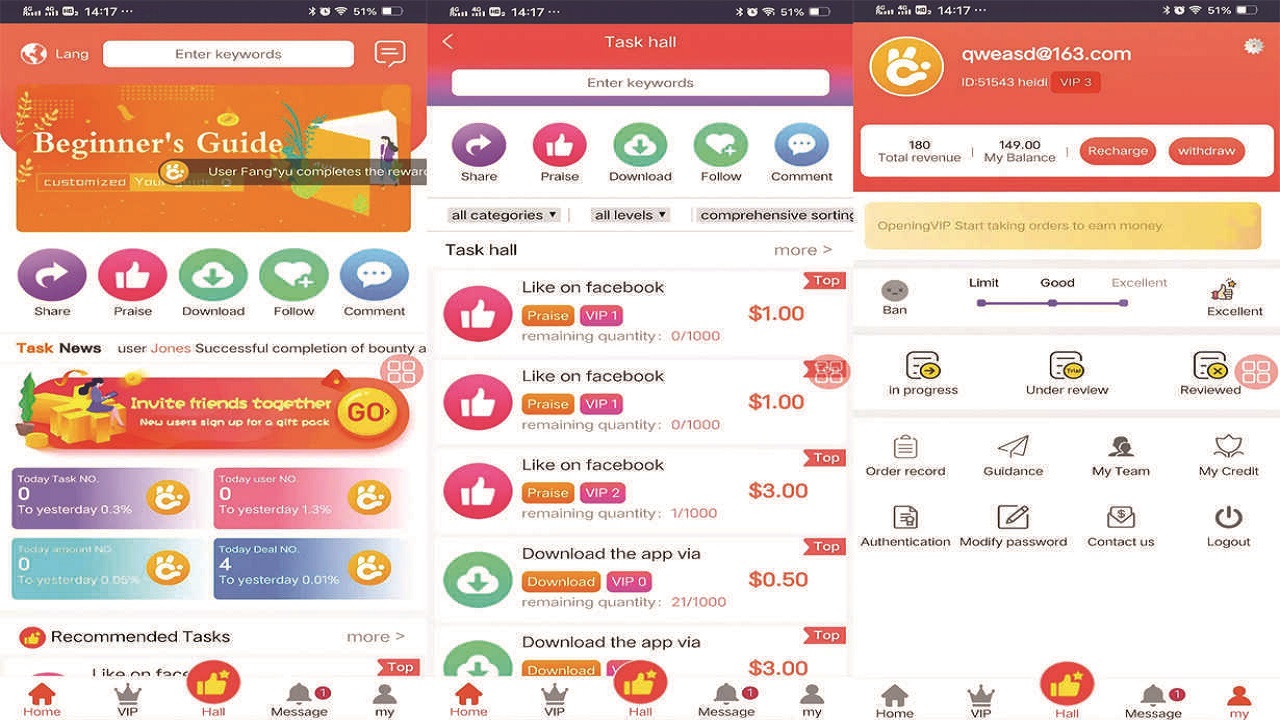

Interface of Golden finger APK latest version

The interface of the Golden Finger app is designed with user-friendliness in mind, featuring a clean and intuitive layout. The home screen typically displays a customizable dashboard, where users can see an overview of their financial information at a glance. This may include account balances, investment portfolio summaries, and expense tracking.

Navigation is usually straightforward, with clearly labeled tabs or menus for various features like budgeting, investment tracking, and news updates. Users can easily input financial data, set budgets, track expenses, and monitor their investments through interactive charts and graphs.

Features in Golden finger APK new version

The Golden Finger app boasts a diverse range of features to cater to users’ financial needs. Some prominent features typically include:

Financial Overview: Users can access a comprehensive snapshot of their financial health, including account balances, net worth, and credit scores.

Budgeting Tools: The app provides tools for creating and managing budgets, tracking expenses, and setting financial goals.

Investment Tracking: Users can monitor their investment portfolios, view performance metrics, and receive real-time market data.

News and Alerts: Golden Finger offers news updates on stocks, cryptocurrencies, and financial markets. Users can set up personalized alerts for price changes and news events.

Financial Education: The app often includes educational resources, such as articles, videos, and tutorials, to help users improve their financial literacy.

Bill Payment Reminders: Users can set reminders for bill payments to avoid late fees and penalties.

Security Features: To ensure data security, Golden Finger typically employs encryption and biometric authentication.

Investment Recommendations: Some versions of the app offer personalized investment recommendations based on user preferences and risk tolerance.

Tax Planning: Users may have access to tools for tax planning, including tax calculators and information on deductions and credits.

Syncing and Integration: The app can often sync with bank accounts, credit cards, and investment accounts, streamlining financial management.

Currency Conversion: For international users, there’s usually a currency conversion feature to facilitate global financial transactions.

Multi-Platform Access: Golden Finger is typically available on multiple platforms, including smartphones, tablets, and desktops, allowing users to manage their finances from anywhere.

How to free download Golden finger APK for Android

To download the Golden Finger app, follow these steps:

- Device Compatibility: Ensure that your device is compatible with the Golden Finger app. Check the app’s system requirements to make sure your device meets them.

- App Store: For iOS devices (iPhone or iPad), open the Apple App Store. For Android devices, open the Google Play Store.

- Search: In the App Store’s search bar (iOS) or the Play Store’s search bar (Android), type “Golden Finger” and press the “Search” button.

- Select: Look for the official Golden Finger app in the search results. It’s important to download the official version from a reputable source.

- Download: Tap on the Golden Finger app icon, then tap the “Download” or “Install” button. Follow the on-screen instructions to complete the download and installation process.

- Permissions: The app may request certain permissions, such as access to your device’s location, camera, or contacts. Review these permissions and grant them as needed for the app to function properly.

- Account Setup: After installation, open the app. You may need to create an account or log in if you already have one. Follow the prompts to set up your account.

- Customization: Customize your account settings, preferences, and financial information as required.

- Explore: Once your account is set up, you can explore the various features and tools offered by the Golden Finger app.

- Security: Be cautious of providing personal or financial information within the app and ensure you are using the official, legitimate version.

Advantages and Disadvantages

Advantages:

- Financial Management: Golden Finger offers a holistic view of your financial situation, helping you manage your money effectively.

- Budgeting: Users can create and track budgets, making it easier to control spending and achieve financial goals.

- Investment Tracking: The app allows users to monitor investments and receive real-time market data, aiding in informed investment decisions.

Disadvantages:

- Privacy Concerns: Using the app may require sharing personal financial data, raising concerns about data privacy and security.

- Learning Curve: Some users may find the app’s features and tools complex, requiring time to learn and utilize effectively.

- Dependence: Relying too heavily on the app for financial management may lead to reduced financial independence and decision-making.

Conclusion

In conclusion, the Golden Finger app offers a wide array of financial management tools and features that can greatly benefit users in managing their finances, budgeting, and tracking investments. It provides convenience, accessibility, and often includes educational resources to enhance financial literacy. Security measures are typically in place to protect user data. Ultimately, the decision to use the Golden Finger app should be based on individual preferences, financial goals, and the specific features and security measures offered by the app’s version. It can be a valuable tool when used wisely in conjunction with sound financial practices.